Business Expansion and the Need for New Payment Integrations

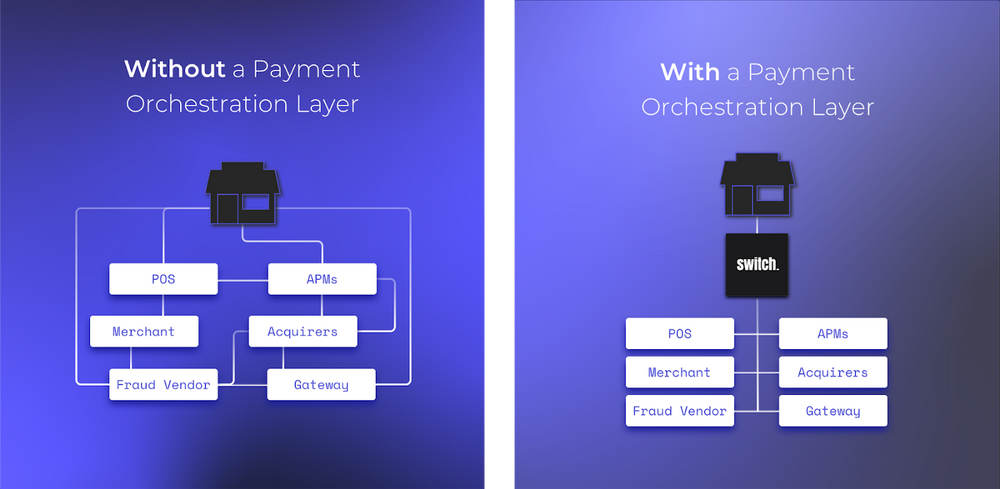

The internet brought innovative business models, and with them came new commerce experiences that have been demanding different transaction flows. The payments industry became increasingly fragmented due to promoted competition by regulators, the emergence of local schemes, and the growing options of payment methods that consumers can choose from.

It’s exciting times for consumers because they have a growing choice of convenient ways to pay for things, but not necessarily so for merchants and financial institutions, which are left with multiple payment stakeholders to integrate with — some of them built on top of arcane legacy infrastructure.

Startups and SMBs might have their problem solved by integrating their payments infrastructure with a Payment Service Provider (PSP) which can aggregate multiple payment methods and value-added services over one single merchant account. They just need to sign one contract, integrate with one API, and they’re ready to go. Funds will eventually end up in their bank accounts and they can focus on the core business. Pretty straightforward, right?

Not quite.

If your company is already a few steps ahead and you’re starting to operate at scale—on multiple channels and business units—it may prove to be insufficient (and inefficient) to have a single PSP managing your funds. You’ll be operating without redundancy and tied to the same pricing and services.

Integrating with multiple PSPs would help you avoid dealing with outages and downtimes, and would add robustness to your payment system to better fit your customers’ preferences. However, this process comes along with many challenges.

The Drawbacks of Developing your Payment Integrations In-house

- Development burden: It’ll require extra time for your teams to develop, and also manage, different payment integrations separately. Your engineering team — who has its queue of endless internal projects — will take ages with every new integration;

- Uncentralized or incompatible analytics: Each PSP has its analytics tool, which prevents merchants from taking valuable insights from the entire payment operations (e.g. total volume, number of payments, average ticket size, percentage of refunds, acceptance rates, etc.);

- Different reconciliation procedures: Distinct data formats cause administrative work overload, making it harder to flag outstanding transactions and overcharges;

- Unexplored synergies between providers: You’ll have to create your own system of rules if you wish to direct transactions to the most appropriate PSP. With the excessive work in integrating and managing each, you may not be spending enough time exploring the full possibilities of communications between them;

- Time-to-Market: There is a lot of dependency between back-office systems and your payment stack (e.g. Billing; ERP; CRM; ERP), and the excessive system coupling may lead to the inability to deploy new services at a fast pace.

Why Adding a Payment Orchestration Platform is the Way to Go

A payment orchestration platfotm not only facilitates the process of accessing an unrestricted number of payment methods and providers (e.g. PSPs, acquirers, processors, gateways, security vendors) through one single API integration but also helps your business scale faster to new markets with the needed flexibility and redundancy.

Switch, in particular, takes advantage of the transactional data that runs through the our orchestration platform to leverage key value-added services:

- Advanced Big Data Analytics: Using big data to process voluminous and complex payment datasets from different providers and extract valuable insights in real-time through a single Dashboard;

- Automatic Reconciliation: Allows a cross-check of the processing events with settlement events to reconcile transactional statements automatically. Payment managers can spot any inconsistencies in processing fees and payout schedules that were previously agreed with the distinct payment providers;

- Smart Payment Routing: Switching transactions in real-time based on rules across all different payment providers to optimize acceptance rates and reduce payment fees. Failed transactions can be processed by subsequent payment providers through fallback rules or, through split rules, merchants can choose which percentages of transactional volume will be processed by which provider;

- Risk Management: Using third-party vendors’ risk engines to either flag or block transactions based on previously defined rules;

- Tokenization: Allowing merchants to tokenize cards — rather than relying on each payment provider to perform tokenization — leverages Dynamic Routing capabilities. By having control over Tokens, merchants can route transactions independently of the provider.

If you are either a merchant experiencing tremendous growth and feeling some of the pain points covered here, or a startup wanting to build a future-proof payment stack, Switch can support you on that journey by providing a truly agnostic and limitless platform to support the ongoing growth of your company.

Reach to us to know how you start optimizing your payments with an orchestration platform.