The History of E-commerce and the New Ecosystem of Payments

Before starting to process credit card payments, most payments in online marketplaces were done by mailing checks or by other payment arrangements made directly between the buyer and seller with no payment processor involved. This was an incredibly time-consuming process for both sides with lots of back and forth communication usually via email. It could take up to 10 days for the payment process to run its course—not to mention the obvious security concerns involved in exposing customers’ payment data.

The very first secure e-commerce transaction was made in 1994. A copy of Sting’s Ten Summoner’s Tales CD bought through the online marketplace NetMarket. This was the first online transaction using encryption software that guaranteed data privacy for customers. The payment method helped pave the way for upcoming e-commerce purchases in online marketplaces, such as Amazon and eBay, in 1995.

The first online payment systems weren’t user-friendly at all and required specialized knowledge of encryption or data transfer protocol.

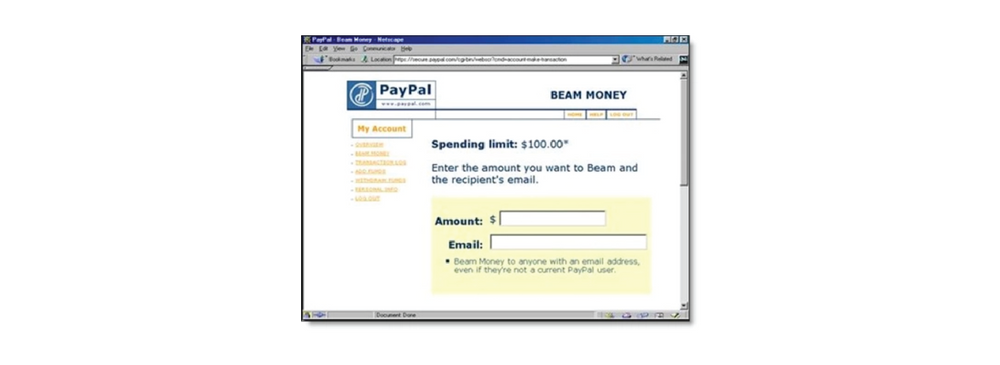

Low cost and effortless digital payments only became possible in 1999 with Paypal (initially named Confinity). The founders’ idea was both simple and efficient: convince customers to share their emails, banking, and credit card information in return for fast and low-cost payments.

Even though there were other online payment systems available, Paypal became widely used by customers partly because it partnered with major US banks and credit card processors. It was the first alternative payment method to emerge globally and it took special widespread adoption when acquired by eBay.

Fast forward 20 years and, according to the 2020 Worldpay Global Payment Report, in 2019 approximately 65% of all e-commerce transactions were made with an APM. The figure is forecasted to rise soon, accounting for 72,4% of all e-commerce payment methods by 2023.

So what are APMs? Alternative payment methods are payment alternatives to cash and to credit/debit card payments from major card networks (Visa, Master, and AmericanExpress). The continuous change of shoppers’ habits and the convenience of using new APMs continues to gradually shape the industry to facilitate online transactions.

Why Should You Care About APMs?

APMs are beneficial for merchants. Accepting them brings numerous advantages to your business such as the following:

- Instant access to a broad range of previously unreachable customers;

- Access to international markets where credit/debit card coverage is low;

- Lower risk of chargebacks as some APMs are non-reversible;

- Optimized processing fees, by reducing processing times and amounts, with real-time acceptance;

- Decrease in cart abandonment.

- APMs remove the friction in the buying process and provide customers the convenience of choice they are looking for, giving them added confidence to purchase. If the method used by customers is local it can mean better conversion rates for the merchant.

What APMs Are Out There?

There are hundreds of APMs used worldwide among direct debit, e-wallets, local card schemes, or cryptocurrencies. Merchants who don’t support such payment methods fall behind their competitors when it comes to addressing customers’ preferences.

Mobile

Mobile payments can be split into two categories: mobile wallets and direct carrier billing.

The process of using carrier billing is simple and quick. Customers can buy digital goods and services by entering only their phone number on the checkout while keeping their privacy safe. The payment is instantaneous, secure and it’s an option to use where credit card usage is low.

Other forms of mobile payments are also revolutionizing the way people in middle and low-income countries are accessing the financial system, allowing them to easily accept payments, send remittances to friends or family. Alternatives like MPesa in Kenya, which offer phone-based money transfer services, payments, and micro-credit services, have helped almost 200,000 households lift themselves above the poverty line.

Examples: Boku, MoPay, Xoom, Swish (Sweden), Pingit, Mobiyo, PayBox.

Digital Wallets

Digital wallets—sometimes mentioned as mobile wallets or e-wallets—are digital versions of customers’ credit or debit cards, stored in an app on a mobile device. According to the 2020 Worldpay Global Payment Report, they already account for 41,8% of all e-commerce transactions. Customers no longer need to carry cards with them when that information is stored on their mobile devices. If you are a merchant with high volumes of traffic coming from mobile, implementing a solution such as this might help increase your conversion rates.

In a time where social distancing and contactless have become the norm, First Bus in the UK adopted Apple Pay and Google Pay as a form of payment. Clients can now buy tickets through contactless technology. They just need to tap their mobile devices in the payment terminal, and they’re good to go. No need to insert the PIN. Apple Express Pay was also implemented to pay for tickets inside the bus.

Examples: Paypal, Google Pay, Apple Pay, Samsung Pay, Alipay (China), Visa Checkout, Wechat Pay (China), Qiwi (Russia), Paga (Nigeria), PayPay (Japan).

Direct Debit

Direct debit means authorizing someone to collect payments from your account when they are recurring, or due, without having to manually insert the payment details. This type of payment method is very popular with subscription services, being one of the most frictionless methods out there. Direct debit can be of advantage to both merchants and clients since discounts are often offered to clients who use direct debit as a payment method. It gives merchants the certainty that the funds will end on their accounts.

Examples: SEPA, ELV (Elektronisches Lastschriftverfahren Germany), Domiciliacion Bancaria (Spain).

Bank Transfers

These payments are made from the customer’s bank account without the need to enter credit card information. The customer orders his bank to execute the transfer of funds. The transfer messages are sent via secure systems like SWIFT using IBAN and BIC codes. The method has proven to be rather easy to use by merchants because it does not require a complex setup and enables them to receive funds from different financial institutions. It’s particularly popular in Europe. Online banking has been a major driver of bank transfers. It offers almost any service available in the traditional bank branches with the added convenience of doing all the processes digitally.

Example schemes: SafetyPay, Sofort, iDEAL (Netherlands), Giropay (Germany), Interac (Canada).

Prepayment and Postpayment

Prepayments require customers to buy or top a card before the transaction takes place and these are immediately authorized. Post payments are initiated by the customer in which authentication and authorization happen after the transaction has already been issued. Usually, post payments take a longer time to be settled, since the payment reference can be generated now and be paid later.

Due to a substantial amount of unbanked consumers and concerns about the security of online transactions, Latin American consumers prefer paying through prepaid paper vouchers. Bar-codes in vouchers are used to pay at local cash-in shops, like convenience stores or lottery branches. Some good examples of this include Boleto Bancário in Brazil and Oxxo in Mexico.

Prepayments examples: Astropay, Postepay (Italy), Neosurf, Paysafecard, Rapipago (Argentina), Toditocash (Mexico). Postpayments examples: Konbini (Japan), Boleto Bancário (Brazil), Oxxo (México), Zip (Australia).

Cryptocurrency

Digital currencies are increasingly getting more attention and work as a medium of exchange. They differentiate themselves from traditional money since transactions and coin ownership are registered in a secure database that also controls the creation of additional digital coins and verifies the transfer of ownership.

Cryptocurrency doesn’t exist in a physical form and it isn’t issued by any central bank. Customers can control how they spend their money without dealing with an intermediary authority like a bank or government. It brings them added privacy as purchases are never associated with the customer’s personal identity. Cryptocurrency also benefits merchants as transactions can’t be reversed and there are no exchange fees associated.

WordPress was one of the first and largest companies to start accepting Bitcoin as a payment method in November 2012. The strategic objective was for WordPress blogs and websites to start accepting payments from countries that were excluded from Paypal or credit card coverage.

Examples: Bitcoin, Litecoin, Ripple, Ethereum.

Cash On Delivery

This payment method is used when the goods are delivered and collected by the courier rather than by the merchant. Cash on delivery is increasingly less prevalent as it is declining in popularity both with merchants and customers. In the current times of a pandemic, the transition towards a cashless society has been specially accelerated.

In countries with low credit card usage like India, cash on delivery is still a preferred method. The major online marketplace in the country, Flipkart, succeeded in part because they were accepting cash on delivery payments showing that the company understood its customers.

Example: Courier services that support cash on delivery (DHL, Shiprocket, UPS, FedEx)

Local Card Schemes

Local card schemes, specific to certain markets, often operate much like traditional cards, but some schemes will be more sophisticated, for instance, offering card and bank transfer options. These schemes generally require the shopper to be redirected to their own pages for payment completion.

The Chinese card scheme UnionPay recently announced partnerships with major online travel agencies in 13 countries in Europe, and 90 countries and regions worldwide. UnionPay payment methods are especially used by Chinese and Asian students and expats in Europe.

Examples: Bancontact (Belgium), UnionPay (China), Carte Bleue (France), Multibanco (Portugal).

Integrating the payment method that better suits your business needs

When choosing a payment method, you need to think about the way it affects your customers. Take into consideration your customer preferences and their privacy concerns as different payment methods ask for more or less customer’s data.

Choosing the right APMs strongly depends on your customer location. The decision becomes especially important for merchants operating on a global scale. If your online sales are low in a particular country, it’s a good practice to research whether there are payment methods that would better suit the local customers.

Keep in mind the transaction fees and monthly fees associated with each payment method. You might be saving money when opting for an alternative payment method or you may find that the investment compensates for the fact you are reaching new customers.

If you are looking for a way to implement a new APM strategy for your business, you can do it through a single integration flow. Through the Switch Dynamic Forms, you can effortlessly set up things on your end and connect with customers around the globe offering their preferred payment methods.

Check our channels page to know more about payment methods at Switch.