Chargebacks Explained

Chargebacks are one of the four steps in payment card disputes: retrieval, chargeback, pre-arbitration (Visa) or second chargeback (Mastercard), and arbitration. Although each phase has its own importance and particularities, chargebacks are the first dispute phase where fund reversibility occurs, so online businesses should pay special attention to them.

The concept of chargeback has been around since the 1970s. Its emergence came from the need to find a protection mechanism for cardholders against fraudulent actions from other users.

In case of card loss, theft, or malicious activities from unscrupulous merchants, chargebacks allow customers the right to always reclaim their funds if they believe the transactions were not justifiably taken by merchants.

A chargeback is a forced transaction reversal initiated by the issuer, often as a request from the cardholder. Liability in the context of chargebacks can end up falling under merchants.

Several studies show an increasing amount of chargebacks over the years across online transactions and reveal that card-not-present (CNP) fraud is 81% more likely to happen than card-present (CP) fraud.

In situations of global crisis, as we are experiencing now with the COVID-19 pandemic, chargeback rates are further aggravated. A NuData Security study shows a dramatic trend up in daily chargeback amount in March 2020, coinciding with the generalization of lockdowns: 124% from goods picked up at stores, and 36% from shipped goods. Additionally, in a recent poll done by Mercator Advisory Group, Inc. 68% of the payment professionals interviewed confirm an increase in disputes volume, and 40% of them add that disputes volume raised between 10% and 50% compared to pre-COVID-19 levels.

By the end of 2020, chargebacks’ financial impact is expected to reach $30 billion worldwide. The financial losses include merchants’ lost revenue, products, shipping costs, and fees.

Card networks have adapted to this new reality by changing dispute rules and deadlines for each intervenient in the process.

Although all types of businesses are susceptible to fraudulent schemes, small and emerging businesses are considered to be the most vulnerable ones due to the lack of knowledge and awareness about chargebacks. If disputes can represent a heavy burden on the budget of already established retailers, for small businesses it can be catastrophic.

The Dispute Process

The dispute process has potentially four stages and merchants tend to avoid their progression. Fees grow with every step and your probability of winning the dispute becomes smaller.

01_Retrieval

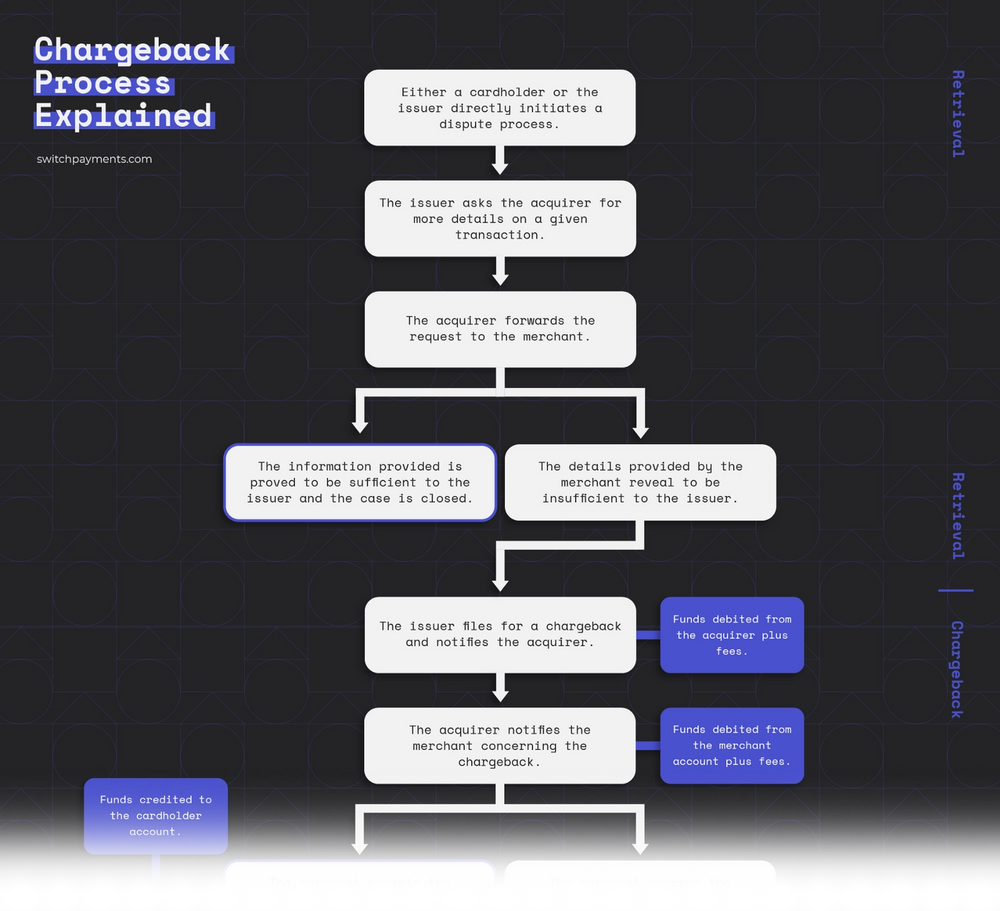

Also known as a soft chargeback, a retrieval request happens when a cardholder or an issuer initiates a dispute. The issuer then asks — through the card networks — the acquirer for more details about a transaction in order to validate it. This is purely a request for information and it does not result in the immediate movement of funds. Two outcomes can arise from this:

- The information provided by the merchant is proved to be sufficient to the cardholder or issuer, so the case is closed;

- The details provided by the merchant reveal to be insufficient to the cardholder or issuer. In this case, the issuer can file for a chargeback to recover the cardholder’s funds.

In order to try to avoid a formally raised dispute, the information provided to the cardholder at this stage should include all the details relevant to the transaction and information that also verifies the cardholder. The merchant needs to provide irrefutable evidence that the cardholder was correctly charged in order to avoid the increasing fees along with the following steps of the dispute process.

02_Chargeback

Depending on the card network and the reason code, a cardholder has 30 to 120 days to dispute a charge. A chargeback dispute process involves back and forth communications between issuers, acquirers, and merchants in order to reach an agreement:

- The issuing bank reviews all pieces of evidence and evaluates their validity. This can take anywhere from 2–6 weeks. If the claim is not valid, the chargeback will simply be voided. If the complaint is found to be reasonable, the issuer assigns a reason code to the dispute and, through the card network’s system, this event is communicated to the acquirer or acquirer processor.

- The acquirer investigates if there’s compelling evidence that would invalidate the dispute. If so, the acquiring bank can act on the merchant’s behalf. However, the most common case is to notify the merchant about the chargeback.

- The merchant has the opportunity to contest the dispute, and ultimately prevent a fund reversal, or to accept it. If the merchant decides to accept the chargeback, its disputed amount is credited to the cardholder’s account.

- If the decision is to oppose the chargeback, the merchant needs to collect all pieces of evidence and send them to the acquirer. There’s a tight deadline to dispute chargebacks: about 7–10 days. The merchant needs to prepare all the compelling evidence that is specific to the dispute’s reason code, which can include a copy of the transaction receipt, shipment confirmation, email exchange with the cardholder, and others, in order to create a comprehensive response.

- The acquirer reviews all pieces of evidence and presents them to the issuer on behalf of the merchant.

- The issuer decides the course of the chargeback, which takes between 4–6 weeks.

- The issuer rules in favor of the cardholder if they find that the merchant has not provided compelling evidence.

- The issuer rules in favor of the merchant if the evidence provided by the merchant has successfully refuted the chargeback. At this point, the cardholder can still decide to file a pre-arbitration or second chargeback and proceed with the dispute process.

03_Pre-Arbitration or Second Chargeback

The pre-arbitration or second chargeback happens when the cardholder does not accept the issuer’s decision on the chargeback. At this stage, the cardholder files for the pre-arbitration and notifies the issuer about it. The issuer communicates with the acquirer, who then informs the merchant.

Once again, the constant exchange of communications between the involving entities happens and the merchant has the chance to decide to challenge or accept the pre-arbitration. The flow is similar to the chargeback process, but with increased fees.

The decision rests again on the hands of the issuer, who, after reviewing all pieces of evidence sent from the acquirer on behalf of the merchant, makes the final assessment. The decision can be in favor of the cardholder or the merchant. In the former, the merchant loses the disputed amount and pays for the fees. In the latter, the merchant gets back the funds minus any fees incurred in the process.

04_Arbitration

If the cardholder can’t come to terms with the decision from the issuer, arbitration is requested. Arbitration involves the relevant card network stepping in to help resolve the dispute between the issuing and acquiring banks, and by extension, the merchant and the cardholder.

The arbitration process involves substantial fees — $400 or more depending on the card network — and adds about 10–45 days to the whole dispute process. Arbitration can mean one of two things:

- The card network rules in favor of the cardholder, adding heavy fees that the merchant must pay;

- The card network rules in favor of the merchant. This means the issuing bank becomes accountable for the fees associated with the arbitration. Take into account that the situation where a card network rules in favor of a merchant during arbitration is extremely rare.

For merchants who have lost the dispute during any of the three cycles, or decided not to contest the chargeback, funds are taken from their accounts, plus any fees incurred.

It’s clear that chargeback dispute processes are way too complex, time-consuming, and expensive. Not only do they involve the loss of the sale, but also add up in heavy chargeback fees. They have the power to irreparably damage your business. So, what do they mean to merchants? And what can you do to avoid them?

If you want to know more about how chargebacks occur and how to fight them back, read Chargebacks: How to Stop Them From Killing Your Business.

In the meantime, get an overview of the steps involved in chargebacks through our Chargeback Process Explained infographic.

Discover the full version of this infographic: click here.